Are you interested in the stock market and considering investing? Would you like to know the latest on Rainbow Hospital’s share price?

Whether you’re interested in recent trends, trading volume, or financial health, this guide will cover everything you need to know. Let’s explore the current data and what it means for your investments to help you make informed investment decisions.

Rainbow Hospital Overview

Rainbow Children’s Medicare Ltd. is a significant player in India’s healthcare sector, focusing on pediatric and maternity care. The company operates several hospitals across the country. The hospital chain is publicly traded on the National Stock Exchange (NSE) and Bombay Stock Trade (BSE) under the ticker symbol “RAINBOW.” It has a strong reputation for its excellent services and extensive network of hospitals across India.

Current Stock Price

- As of August 6, 2024, the share price of Rainbow Children’s Medicare Ltd. is ₹1,197.10.

- This marks an increase of ₹29.45, or 2.52%, from the previous day.

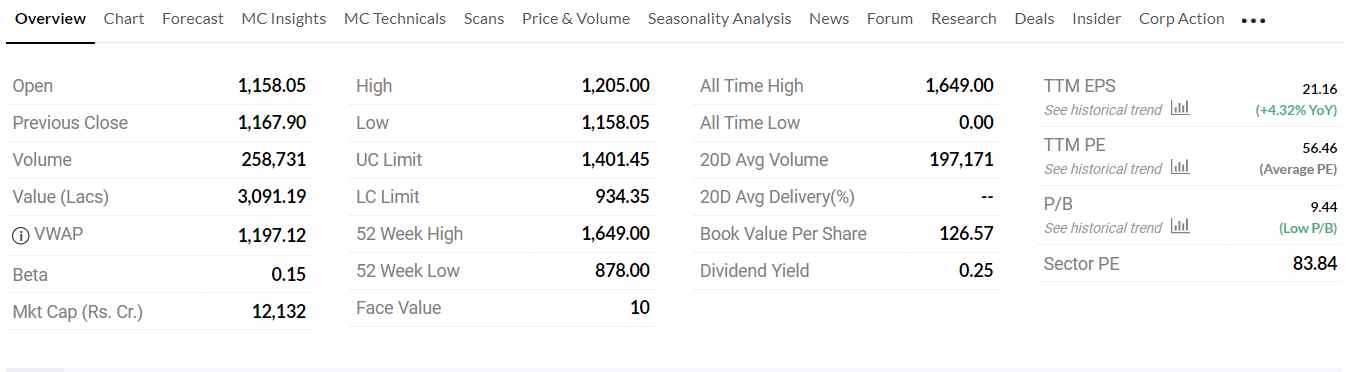

Rainbow Hospital Share Price Daily Trading Range

- Lowest Price Today: ₹1,158.70

- Highest Price Today: ₹1,203.00

52-Week Price Range

- Lowest Price in 52 Weeks: ₹878.00

- Highest Price in 52 Weeks: ₹1,649.00

Rainbow Hospital Share Price Trading Volume

- Current Volume: 4,241 shares

- Average Volume Over 20 Days: 197,171 shares

Key Metrics of Rainbow Share Price

- Market Capitalization: ₹12,132 crore

- Face Value of Each Share: ₹10

- Book Value per Share: ₹126.57

- Dividend Yield: 0.25%

- Earnings per Share (EPS): ₹21.16 (up 4.32% from last year)

- Price-to-Earnings (P/E) Ratio: 56.46 (compared to the sector average of 83.84)

- Price-to-Book (P/B) Ratio: 9.44

Rainbow Children Share Price Technical Insights

- Volume Weighted Average Price (VWAP): ₹1,197.12

- All-Time Highest Price: ₹1,649.00

- All-Time Lowest Price: ₹410.00

- Upper Circuit Limit: ₹1,401.45

- Lower Circuit Limit: ₹934.35

Forecast and Recommendations of Rainbow Hospital Share

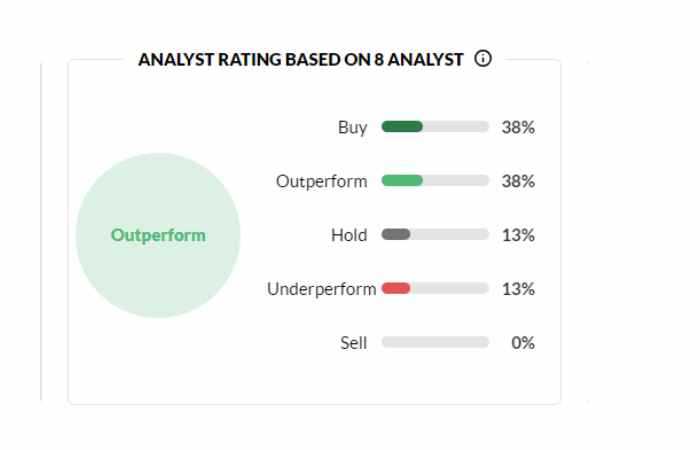

Analyst Ratings:

- Buy: 38%

- Outperform: 38%

- Hold: 13%

- Underperform: 13%

- Sell: 0%

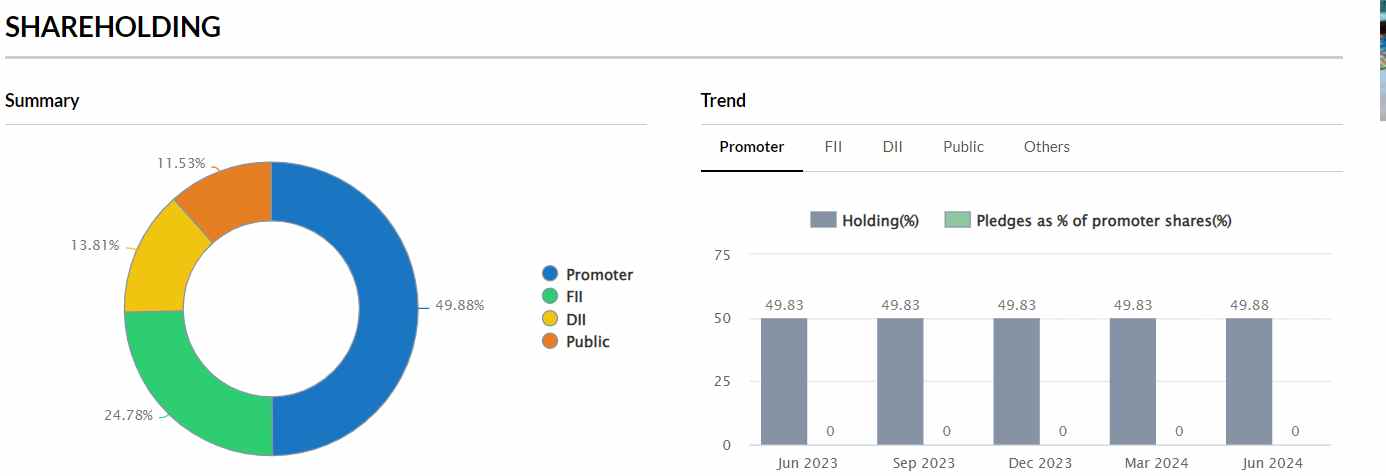

Strengths of Rainbow Children’s Medicare Share Price

- Debt-Free: The company has no debt, which is a positive sign for investors.

Weaknesses of Rainbow Children Hospital Share

- Reduced Mutual Fund Holdings: Mutual funds have recently decreased their stake in the company.

Rainbow Childrens Share Price Opportunities

- High Trading Volume: The stock has high trading volumes and recent gains, suggesting strong interest.

Rainbow Hospital Share Price Threats

- High P/E Ratio: The high P/E ratio might indicate that the stock is overvalued compared to historical averages.

Threats of Childrens Share Price Opportunities

High P/E Ratio: The high P/E ratio might indicate that the stock is overvalued compared to historical averages.

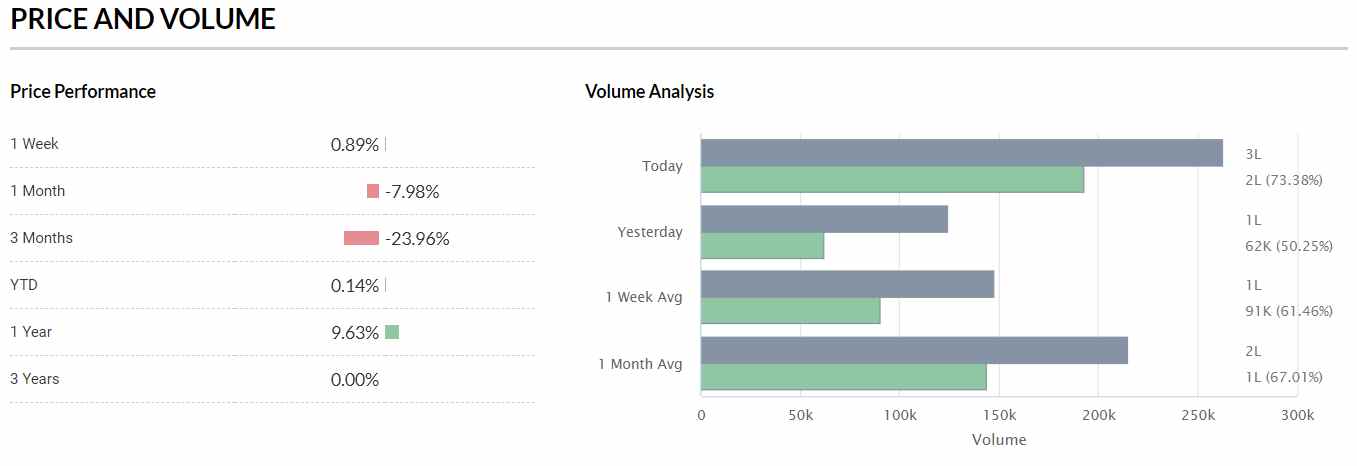

Price Performance of Rainbow Hospital Share

Previous Close: ₹1,167.90

Current Price Change: +2.30%

Advanced Chart Analysis

Price Movement: The stock has shown considerable volatility over the past year, trading between ₹992.95 and ₹1,649.00. Recent trends indicate a recovery from lower levels, with resistance around ₹1,203.00 and support at ₹1,158.70.

Factors Influencing Rainbow Hospital’s Share Price

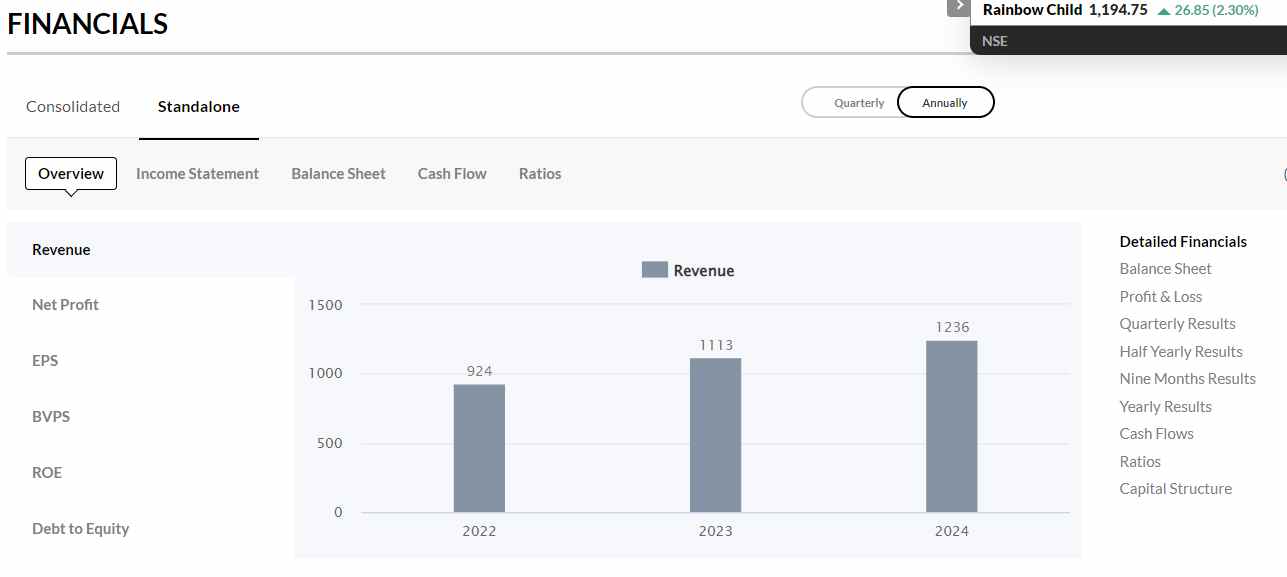

Financial Performance

- Revenue and profitability

- Cost management

Market Conditions

- Healthcare sector trends

- Economic environment

Regulatory Environment

- Healthcare regulations

- Compliance and accreditation

Company Initiatives

- Expansion plans

- Innovations and technology

Financial Health and Investment Metrics

- Valuation metrics (P/E ratio, P/B ratio)

- Debt levels

Market Sentiment and Investor Perception

- Stock market trends

- News and public relations

Competitor Landscape

- Competitive position

- Market share and growth

Global Health Trends

- Pandemic and health crises

Tips and Tricks for Analyzing and Investing in Rainbow Hospital’s Stock

Monitor Financial Reports

- Regularly review earnings

- Assess financial ratios

Stay Updated on Market Conditions

- Track healthcare trends

- Watch economic indicators

Understand Regulatory Impact

- Review regulatory changes

- Monitor compliance

Evaluate Company Initiatives

- Follow expansion news

- Watch for innovations

Analyze Trading Volume and Trends

- Observe trading volume

- Use technical indicators

Assess Market Sentiment

- Read analyst reports

- Watch for news

Evaluate Competitive Position

- Compare with peers

- Assess market share

Prepare for Health Crises

- Review crisis response

- Evaluate adaptability

Competitors of Rainbow Hospital’s Stock

- Max Healthcare Institute Ltd.

- Apollo Hospitals Enterprise Ltd.

- Fortis Healthcare Ltd.

- Narayana Health

- Medanta – The Medicity

- Hiranandani Hospitals

- Kokilaben Dhirubhai Ambani Hospital

Conclusion

Rainbow Children’s Medicare Ltd.’s stock exhibits solid financial performance but with a high valuation. Analysts recommend a mixed outlook, with a significant proportion suggesting “Buy” or “Outperform.” Investors should consider the company’s lack of debt and high P/E ratio in their decision-making process. The stock’s recent gains and high trading volume reflect positive sentiment, but careful consideration of its valuation and market conditions is advised.